News & Media

Foundation News

Key management committee members of ESG Future Foundation have successfully developed a new IEEE standard:

P2781-2022 “IEEE Guide for Load Modeling and Simulations for Power Systems” is now released by the IEEE Standards Association.

Prof. Junhua ZHAO from the Chinese University of Hong Kong has 11 years of experience in the power industry in Australia. His research area includes smart grid, electricity market, energy economics, data mining and artificial intelligence.

The IEEE standard P2781-2022 provides comprehensive policies and procedures of load modeling and simulations, and includes guidance for developing load models, identifying load model parameters, and utilizing measurement data for load model development at various voltage levels. This standard enables more accurate simulations of power system operation. Based on this standard, more accurate approaches and results of power system carbon intensity and carbon accounting will be achieved, and the high proportion of renewable energy integration in the power system will develop towards a more stable and economic direction.

News

- ESG News

- May 13, 2024

Malaysian Carbon Exchange to Host Historic First Auction of Local Carbon Credits

Bursa Carbon Exchange (“BCX”), a wholly-owned subsidiary of Bursa Malaysia Berhad (“Bursa Malaysia”), will be hosting the highly anticipated auction of its first Malaysian carbon credits on 25 July 2024. The auction of carbon credits from the Kuamut Rainforest Conservation Project (‘Kuamut Project’) marks a significant milestone for BCX on several fronts – the offering of its first Malaysia Nature-based Carbon Credits Plus (MNC+) generated via a domestic forestry project; and the expansion of BCX’s product offering to include local carbon credits in addition to global carbon credits.

- ESG News

-

May 10, 2024

ESG Book, SAP Fioneer ESG Solutions Partner to Bring Transparent Sustainability Data Integration

SAP Fioneer, a leading provider of financial services software solutions and platforms, has entered a partnership with ESG Book, a global leader in sustainability data. The collaboration combines ESG Book’s high-quality data on emissions with the data orchestration and complex calculation functionality of the SAP Fioneer ESG KPI Engine. Financial services institutions benefit from the combined capabilities that enable them to meet complex regulatory requirements and adopt better ESG-related decision-making through improved transparency on portfolio and single exposure level.

- ESG News

- May 10, 2024

Amazon Launches Their Largest-ever Fleet of Heavy-duty Electric Trucks across Southern California

“We’re proud to launch our largest fleet of electric heavy-duty vehicles yet in California,” said Udit Madan, vice president of Worldwide Amazon Operations. “Heavy-duty trucking is a particularly difficult area to decarbonize, which makes us all the more excited to have these vehicles on the road today. We’ll use what we learn from deploying these vehicles as we continue to identify and invest in solutions to reduce emissions in our transportation network, and to impact sustainability in the trucking industry more broadly.”

- ESG News

- May 3, 2024

General Motors Releases 2023 Sustainability Report, Outlines Path to Zero Emissions

“Sustainability is not just good policy. It’s good business — good for the company, for employees, and for recruiting and retaining the best people, people who will help us achieve our vision,” said GM Chair and CEO Mary Barra. “We’ve made tremendous strides through our investments and innovations in electric and autonomous technology, and we’re going to expand our reach, especially with many important EV launches across a wide range of price points and segments this year.”

- ESG News

- April 29, 2024

PwC Report: Over 70% of Critical Minerals for Net Zero Transition at Risk Due to Climate Change

PwC’s Connected Tax Compliance Strategy is being built to accelerate client outcomes. Enhancing the data used in tax compliance is a critical component of business transformation, which is why PwC is working with Google Cloud to develop and deploy a new data platform to facilitate the delivery of Connected Tax Compliance globally. The offering combines PwC’s vast breadth and depth of tax experience across more than 150 countries with Google Cloud’s leading data analytics, cloud, and artificial intelligence capabilities. The two organisations will focus on delivering a modern and flexible tax compliance solution to meet the challenges presented by an increasingly complex, data-driven global tax reporting and regulatory environment.

- ESG News

- April 29, 2024

Microsoft Introduces AI-Powered Tools for Sustainable Business Strategies to Sustainability Platform

Microsoft Sustainability Manager is rapidly evolving with the power of generative AI, offering unprecedented capabilities for data analysis and informed decision-making.

- ESG News

- April 26, 2024

Hong Kong Exchange Mandates IFRS-based Climate Disclosure Starting 2025

The Stock Exchange of Hong Kong (HKEX) is set to become a global leader in sustainability reporting with the implementation of mandatory climate-related disclosure requirements for listed companies. These new requirements, known as the “New Climate Requirements,” were announced by HKEX after receiving “broad-based support” during a consultation process. Aligned closely with the International Sustainability Standards Board’s (ISSB) IFRS S2 standards, the New Climate Requirements aim to bring transparency and standardization to sustainability reporting in Hong Kong’s capital markets.

- ESG News

- April 26, 2024

New Climate Alliance for Insurance Transition to Net Zero Emerges Amid ESG Pressures

The insurance industry has a crucial role to play in combating climate change. Recognizing this, the United Nations Environment Programme (UNEP) recently launched a new initiative, the Forum for Insurance Transition to Net Zero (FIT), to accelerate voluntary climate action within the sector. This forum takes the place of the disbanded Net-Zero Insurance Alliance (NZIA).

- ESG News

- April 25, 2024

EU Parliament Sets Stricter Air Quality Laws for 2030 to Reduce Pollution and Premature Deaths

- Stricter 2030 limits for several air pollutants

- Air quality indices to be comparable across all member states

- Access to justice and right to compensation for citizens

- Air pollution leads to around 300,000 premature deaths per year in the EU

The revised law aims to reduce air pollution in the EU for a clean and healthy environment for citizens, and to achieve the EU’s zero air pollution vision by 2050.

- ESG News

- April 22, 2024

World Bank and African Development Bank Partner to Electrify 300 Million in Africa by 2030

World Bank Group, African Development Bank initiative could halve the number of people in Africa living without electricity access

The World Bank Group and African Development Bank Group are partnering on an ambitious effort to provide at least 300 million people in Africa with electricity access by 2030.

The World Bank Group will work to connect 250 million people to electricity through distributed renewable energy systems or the distribution grid while the African Development Bank Group will support an additional 50 million people.

- ESG News

- April 18, 2024

JP Morgan to Invest $2.5 Trillion for Sustainable Development Financing by 2030 – Reveals New 2023 ESG Report

Key Impact Points:

- Environmental Footprint Reduction: JPMorgan Chase reported a commendable 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to 2019 levels, signaling progress towards carbon neutrality by 2030.

- Sustainable Finance Leadership: The firm facilitated over $200 billion towards green financing initiatives, including renewable energy projects and green bonds, contributing towards its ambitious $2.5 trillion sustainable development financing target by 2030.

- Workforce Diversity Milestones: Achieving 50% gender diversity globally and 45% ethnic diversity within U.S. operations underscores JPMorgan Chase’s commitment to fostering an inclusive workplace culture.

- Community Development Investments: JPMorgan Chase invested over $500 million in community development programs, focusing on affordable housing and small business support in underserved communities, driving positive social impact.

- Progress Towards Sustainable Development Targets: With $300 billion directed towards green initiatives and $120 billion towards development finance in 2023 alone, the firm is making tangible strides towards its Sustainable Development Targets, demonstrating its dedication to sustainable economic growth.

- ESG News

- April 17, 2024

Apple Triples Clean Energy Amount From 2020 and Pledges Net-Zero Charging by 2030

Key Impact Points:

- Apple and its suppliers have surpassed 18 gigawatts of clean electricity, tripling the amount from 2020.

- The company aims to replenish 100 percent of the fresh water used in corporate operations, launching partnerships to deliver nearly 7 billion gallons in water benefits over the next 20 years.

- Over 320 suppliers, representing 95 percent of Apple’s direct manufacturing spend, have transitioned to clean electricity, resulting in 16.5 gigawatts of renewable energy online.

- Apple pledges to match every watt of charging electricity with clean electricity by 2030, investing in solar projects in the U.S. and Europe.

- The tech giant is committed to nature-based solutions for water resilience, including projects to restore flood plains and protect forests.

- Ian Wilding

- April 17, 2024

Ensuring Verified Outcomes In Corporate Acceleration For ESG And Venture Ecosystem Impact

Based on my experience working with some of the most innovative and forward-thinking accelerators, and my lean toward outcome measurement, this article encapsulates a comprehensive strategy for governing boards to ensure their corporate acceleration programs deliver real value, fostering both sustainable development and a thriving venture ecosystem.

- ESG News

- April 16, 2024

Biden-Harris Administration Exceeds 25 Gigawatt Clean Energy Target on Public Lands

The Biden-Harris administration announced a series of historic milestones and actions to promote responsible clean energy development on public lands and help achieve President Biden’s goal of creating a carbon pollution-free power sector by 2035.

Secretary of the Interior Deb Haaland announced that the Department has now permitted more than 25 gigawatts of clean energy projects – surpassing a major milestone ahead of 2025 – enough clean energy to power more than 12 million homes across the country. This includes solar, wind and geothermal projects, as well as gen-tie lines on public lands that are essential for connecting clean electricity projects on both federal and non-federal land to the grid.

- ESG News

- April 16, 2024

New Global Wind Report Reveals Record Year for Wind Energy but Highlights Need for Policy-Driven Action

The global wind industry installed a record 117GW of new capacity in 2023, making it the best year ever for new wind energy. Despite a turbulent political and macroeconomic environment, the wind industry is entering a new era of accelerated growth driven by increased political ambition, manifested in the historic COP28 adoption of a target to triple renewable energy by 2030.

- ESG News

- April 15, 2024

Norway Eyes Large-Scale Carbon Removal with Government Funding for Climeworks Study

Climeworks, the global leader in carbon dioxide removal (CDR) via DAC+S technology, has been awarded 2.2m CHF (26m NOK) in funding from Enova, at 50 percent funding intensity, in the framework of Enova’s “Preliminary Study Carbon Capture 2030”. Enova aims to help companies that want to capture large amounts of CO₂ to get closer to an investment decision for capture plants, with the goal of operation by 2030. Climeworks is one of nine projects awarded, whose combined targeted capture capacity totals 1.7m tons of CO₂ per year. This corresponds to almost half of all emissions from passenger cars in Norway.

- ESG News

- April 10, 2024

B Capital Expands Climate Focus with Strategic Hires: Rich Lesser and Jeff Johnson Join the Team

B Capital, a global multi-stage investment firm, announced two appointments to further expand its climate investment platform. Rich Lesser, Global Chair and former CEO of Boston Consulting Group (“BCG”), has joined as Vice Chair, Climate & Sustainability and Senior Advisor to help drive the firm’s strategic direction in climate and sustainability. He will continue in his role at BCG and strengthen the links between the two firms in this critical area. Additionally, Jeff Johnson has joined as General Partner to lead the firm’s growing climate investment team with nearly 25 years of experience in sustainable technology.

- ESG News

- April 10, 2024

Swiss Government Renews its Contribution to the Green Climate Fund

Switzerland will continue to support the Green Climate Fund (GCF) with a total contribution of CHF 135 million over the next four years. The Federal Council took this decision at its meeting on 10 April 2024. The GCF helps developing countries take concrete action to achieve the goals of the United Nations Framework Convention on Climate Change and the Paris Agreement. In particular, it funds initiatives aimed at reducing greenhouse gas emissions and adapting to climate change.

- ESG News

- April 8, 2024

EY Establishes Global Sustainable Finance Innovation Hub in Dublin to Drive ESG Advancements for Financial Institutions

Colin Ryan, EY Ireland Financial Services Country Lead, comments: “The financial services sector plays a central role in the transition to a more sustainable future and we are now significantly expanding our capacity to deliver end-to-end sustainable finance transformation services to clients in the sector. The addition of 40 specialist hires across the three pillars of ESG will see our Dublin hub become a globally significant centre for innovation in the area of sustainable financial services. The sector must comply with an increasing volume of regulatory requirements over the coming years, and many firms already face multiple deadlines this year alone. Our new hub will support firms to more effectively report on their activity and will help clients ensure that they remain compliant with the evolving regulatory environment.”

- ESG News

- April 5, 2024

JPMorgan, Citi, RBC Reach Agreement with NYC on Climate Finance Disclosures

“Despite their commitments to decarbonize, U.S. and Canadian banks have financed over $1 trillion of fossil fuel extraction since the Paris Accords. The transition from financing fossil fuels to low-carbon energy is going far too slowly – and thus far, it hasn’t even been possible for shareholders to track,” said Comptroller Brad Lander. “We appreciate JPMorgan, Citi, and RBC agreeing to provide greater transparency so that long-term investors can more effectively measure how well they are or aren’t living up to their commitments. As leading public investors, we expect that energy supply ratio disclosure will become a new standard for the banking sector. We call on Bank of America, Goldman Sachs, and Morgan Stanley to follow suit at a time when our planet and investment portfolios are at risk.”

- ESG News

- April 5, 2024

US SEC Pauses Climate Disclosure Rule Pending Court Challenge

The U.S. Securities and Exchange Commission (SEC) has announced a suspension in the enforcement of its climate disclosure rule while awaiting the outcome of a legal challenge initiated by a group of Republican-led states. This rule, established in March, compels companies to disclose any potential risks posed by climate change to their operations and, for certain larger and mid-sized firms, to report their carbon dioxide emissions. This regulatory pause reflects the SEC’s strategy to navigate the legal contestation without indicating any retreat from its commitment to the rule’s objectives.

- ESG News

- April 4, 2024

80% of Global CO2 emissions can be traced to just 57 producers, report says

A new report by InfluenceMap, titled “The Carbon Majors Database: Launch Report,” sheds light on a critical aspect of the climate crisis. It reveals a concerning concentration of greenhouse gas emissions, with a mere 57 fossil fuel and cement producers responsible for a staggering 80% of global CO2 emissions since the signing of the Paris Agreement in 2016. This translates to 251 GtCO2e (gigatonnes of carbon dioxide equivalent) – a colossal figure highlighting the outsized role a select group of corporations plays in driving climate change…

- ESG News

- April 3, 2024

USDA Releases Updated Greenhouse Gas Methods Report for Agriculture and Forestry

“USDA’s updated greenhouse gas methods report represents a critical scientific consensus which ensures confidence in the benefits from climate-smart agriculture and forestry,” said Agriculture Secretary Tom Vilsack. “This report will help guide conservation efforts, improve our greenhouse gas estimation on U.S. farms, and support markets for carbon and climate-smart products nationwide.”

- ESG News

- April 1, 2024

Biden-Harris Administration Unveils $4 Billion Tax Credit Initiative to Strengthen Clean Energy Supply Chain and Drive Investments

“From direct grants to historic tax credits, the President’s Investing in America agenda is making the nation an irresistible place to invest in clean energy manufacturing,” said U.S. Secretary of Energy Jennifer M. Granholm. “The President’s agenda places direct emphasis on communities that have traditionally powered our nation for generations, helping ensure those communities reap the economic benefits of the clean energy transition and continue to play a leading role in building up the next wave of energy sources.”

- ESG News

- Mar 28, 2024

Australia creates $1 billion fund called Solar Sunshot to expand solar panel manufacturing

The $1 billion Solar Sunshot program stands as a pivotal initiative. As Prime Minister Anthony Albanese emphasizes, Australia possesses the potential to be a frontrunner: “There is no nation on earth better placed than Australia to achieve the energy transition here at home and power it in the world.” Solar Sunshot directly targets domestic solar panel manufacturing, a move that will create a multitude of new jobs and capitalize on Australia’s existing strengths in solar energy.

- ESG News

- Mar 27, 2024

The presidents of France and Brazil meet and launch $1.1 bln program to protect Amazon rainforest

In a landmark move, the French and Brazilian presidents announced a $1.1 billion initiative aimed at preserving the Amazon rainforest, signaling a renewed partnership between France and Brazil. This collaboration involves contributions from both private and public funds over a four-year span, emphasizing the joint commitment of both nations to environmental conservation.

- ESG News

- Mar 25, 2024

South Korea Unveils $313 Billion Green Financing Plan to Combat Climate Change

South Korea has pledged a significant financial commitment to tackling climate change, announcing a $313 billion green financing plan. This initiative aims to slash greenhouse gas emissions by 40% from 2018 levels by 2030.

- ESG News

- Mar 25, 2024

Study Finds Climate Change Poses Inflation Risks: Rising Temperatures to Drive Up Prices

“We estimate that the 2022 summer heat extreme increased food inflation in Europe by about 0.6 percentage points. Future warming projected for 2035 would amplify the impacts of such extremes by up to 50 percent,” explains Maximilian Kotz, PIK scientist and first author of the study. “These effects are very relevant for currency unions with a two percent inflation target such as the Euro zone, and will continue to increase with future global warming.”

- ESG News

- Mar 22, 2024

Billups Partners with Cedara to Pioneer Global OOH Sustainability Solution

“As part of Billups’ commitment to driving global innovation, we are eager to accelerate sustainability efforts within the OOH industry,” said David Krupp, Global CEO of Billups. “Working with Cedara will ensure we accurately measure and report on the environmental impact our clients’ campaigns generate and that appropriate mitigation efforts are undertaken. Providing the tools necessary to understand and, critically, reduce carbon impact supports our clients in achieving their sustainability goals, helping to create a cleaner future.”

- ESG News

- Mar 20, 2024

JLL and Jupiter Intelligence Partner to Integrate AI-Driven Climate Risk Analytics into Real Estate Decarbonization Strategy

“Jupiter’s AI-powered climate models provide a valuable layer to JLL‘s Decarbonization Strategy Services,” said Guy Grainger, Global Head of Sustainability Services and ESG for JLL. “Our Decarbonization Services help owners and occupiers create a clear investment roadmap to reduce harmful emissions and enhance value in their portfolio. Layering in Jupiter’s gold standard climate risk analytics allows us to also measure what might be happening in the environment and how that could impact overall real estate valuation and decarbonization efforts.”

- ESG News

- Mar 19, 2024

Oracle Launches Sustainability Reporting, Management Cloud ERP Platform

“Many organizations are beginning to treat sustainability reporting requirements with the same rigor, governance, and technical expertise as financial reporting,” said Hari Sankar, group vice president, Product Management at Oracle. “With Oracle Cloud EPM for Sustainability, our customers can leverage a trusted solution that embeds AI and other advanced technologies to help improve efficiency, deliver insights, promote compliance, and effectively manage their progress on sustainability initiatives.“

- ESG News

- Mar 15, 2024

Shell Invests $15 Billion into Low-Carbon Energy Solutions While Aiming to Cut Emissions

“Energy has made an incredible contribution to human development, allowing many people around the world to live more prosperous lives. Today, the world must meet growing demand for energy while tackling the urgent challenge of climate change. I am encouraged by the rapid progress in the energy transition in recent years in many countries and technologies, which reinforces my deep conviction in the direction of our strategy,” said Wael Sawan, Shell’s Chief Executive Officer.

- ESG News

- Mar 14, 2024

Net-Zero Banking Alliance Tightens Guidelines for Banks’ Climate Targets

“This bank-led update to the Guidelines, and its important addition of facilitated emissions from capital market activities, ensures that current and future NZBA member banks will continue to set targets in line with the most ambitious temperature goals of the Paris Agreement and the latest science,” said Eric Usher, Head of the UN Environment Programme Finance Initiative (UNEP FI). He continued: “Doing so positions these banks to prosper as economies around the world decarbonise and transition towards a cleaner, healthier, and more resilient future.”

- Hooman Shahidi

- Mar 13, 2024

Five Ways Modern Enterprises Can Take Advantage Of ESG

ESG is an essential component of a viable business strategy because the effort and investment companies make in ESG principles are likely to create value. With this in mind, here are five high-level ways your ESG efforts can pay off.

- ESG News

- Mar 8, 2024

NatPower commits £10 Billion to UK’s biggest battery plan, driving path to 100% renewable energy by 2035

Fabrizio Zago, CEO of the NatPower Group declares : “We are proud to announce NatPower’s investment plan in the United Kingdom which will give new impetus to the promotion of an energy system fully focused on renewables and will accelerate the country’s path towards achieving net gas emissions greenhouse equal to zero. Today we present the largest program for the development of battery energy storage systems for over 60 GWh in the UK and we are ready to collaborate with institutions and players in the sector to make the energy production system increasingly efficient”.

SEC Sets New Standard with Climate-Related Disclosure Rules for Public Companies

“Our federal securities laws lay out a basic bargain. Investors get to decide which risks they want to take so long as companies raising money from the public make what President Franklin Roosevelt called ‘complete and truthful disclosure,’” said SEC Chair Gary Gensler. “Over the last 90 years, the SEC has updated, from time to time, the disclosure requirements underlying that basic bargain and, when necessary, provided guidance with respect to those disclosure requirements.”

- ESG News

- Mar 7, 2024

- ESG News

- Feb 28, 2024

S&P Dow Jones Indices Announces Launch of Innovative Biodiversity-Focused Benchmarks

“S&P Dow Jones Indices’ approach to index design reflects a holistic view of the vast sustainability ecosystem and biodiversity is an important part of this equation,” said Jas Duhra, Global Head of Sustainability Indices at S&P DJI. “The S&P Biodiversity Indices are designed to help offer additional insights for our clients and market participants who are seeking to measure, analyze and better understand their investments’ impact on the natural world, and support their goals to create a more resilient and ecologically conscious investment landscape.”

Canada to Issue Innovative Green Bond Including Nuclear Energy

The Government of Canada’s green bonds will meet demand from investors seeking green investment opportunities backed by Canada’s AAA credit rating, while contributing to the development of a stronger sustainable finance market in Canada.

- ESG News

- Feb 28, 2024

- ESG News

- Feb 27, 2024

Brazil Partners with Largest Climate Finance Alliance to Scale Climate Finance for Green Growth Plans

“Brazil’s historic commitments and its track record of innovation have made it a global climate leader. Now its renewed ambitions are creating the unique opportunity to accelerate strong, sustainable, and inclusive growth,” said Mark Carney, UN Special Envoy on Climate Action and Finance and GFANZ Co-Chair. “The Climate Transition Platform and the GFANZ Country Chapter will bring together the best in Brazilian finance and industry to support the essential data, transition planning and investment that this ambitious, essential transition requires.”

How To Recognize ESG Reporting Risks And Opportunities In 2024

According to Gartner, 85% of investors consider ESG factors in their due diligence. And employees and customers are also paying close attention, with 66% of consumers saying they would pay more for sustainable products.

With this shift in mind, our research found that 90% of senior accounting and finance executives are looking to implement new sustainability goals over the next two to five years.

- Joe Fitzgerald

- Feb 21, 2024

- ESG News

- Feb 20, 2024

Green finance experts unveil blueprint for mobilising net zero investment

The report highlights the growing need for private finance to meet the UK’s net-zero goals, estimating an annual requirement of £50bn to £60bn by 2030. To attract this investment, the report recommends:

- Deeper public-private collaboration

- Investable transition pathways

- Catalytic public finance

- Addressing policy and regulatory barriers

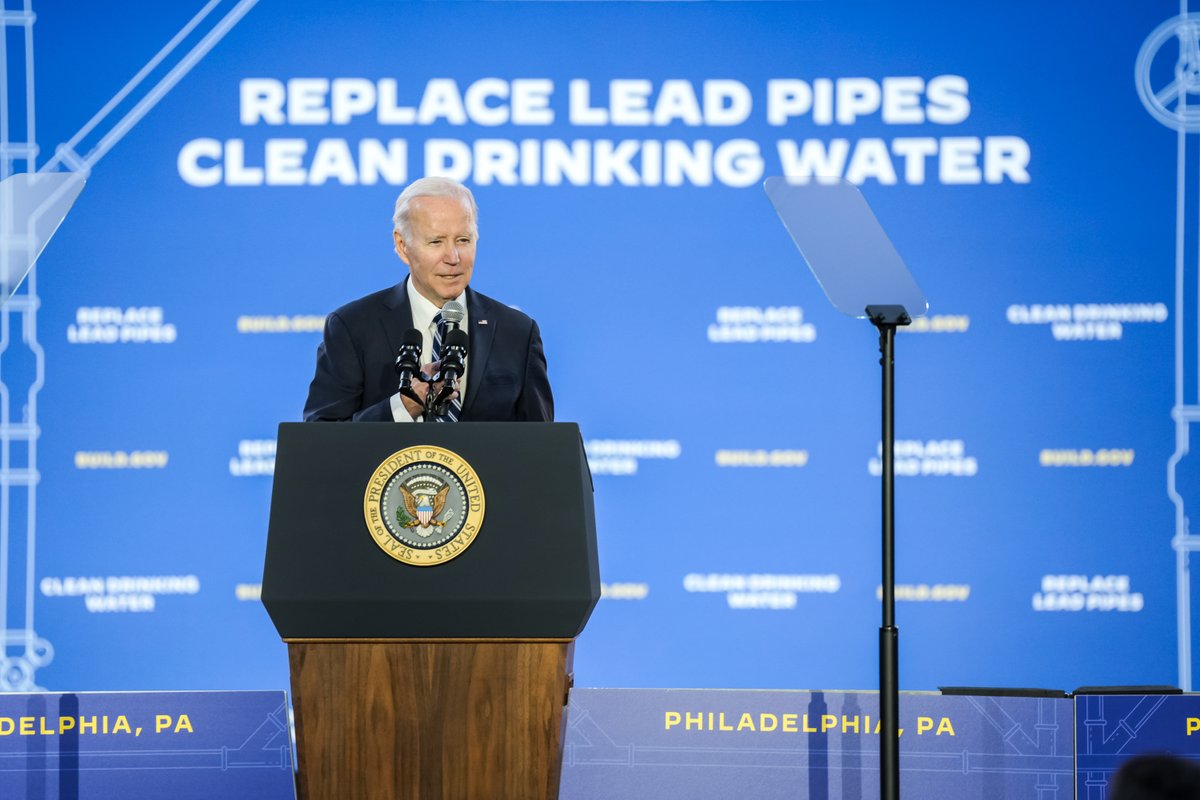

Biden-Harris Administration Invests $5.8 Billion in Clean Water Infrastructure

“President Biden and I believe that every person in our country should have a right to clean water no matter where they live or how much money they make. That is why our Administration made clean water a national priority and delivered the largest investment in America’s water infrastructure in history,” said Vice President Harris. “Today, I am proud to announce more than $5.8 billion from our Investing in America agenda for states, Tribes, and territories to upgrade water infrastructure in communities across our nation…”

- ESG News

- Feb 20, 2024

- Megan Trotter

- Feb 16, 2024

ESG Regulations Are Here — 5 Actions Companies Should Take Now

ESG has long been a nice-to-have, an opportunity for businesses to showcase purpose over profit. Now, a rapidly evolving regulatory landscape means that companies will have to embrace innovation and start implementing, monitoring, and reporting on their ESG efforts—or face penalties down the road.

EU Sets New Standards to Combat Greenwashing with Verification Requirements

The so-called green claims directive complements the already-approved EU ban on greenwashing. It defines what kind of information companies have to provide to justify their environmental marketing claims in the future. It also creates a framework and deadlines for checking evidence and approving claims, and specifies what happens to companies who break the law.

- ESG News

- Feb 15, 2024

- ESG News

- Feb 12, 2024

Barclays Revises Climate Policy to Strengthen Support for Sustainable Energy Transition

London, 09 February 2024 – Barclays today publishes a revised Climate Change Statement to progress its climate strategy and continues its focus on clients actively engaged in the energy transition. Following Barclays’ commitment to finance $1trillion of Sustainable and Transition Finance by 2030, Barclays also releases a Transition Finance Framework to support us to meet that target and facilitate the transition finance needed to decarbonise high-emitting sectors.

HSBC and Google Cloud Launch Partnership to Boost Climate Technology Ventures

- Collaboration to support companies in “Google Cloud Ready – Sustainability” ecosystem, through financing and tech support

- HSBC delivers partnership’s first venture debt funding, to LevelTen Energy

- ESG News

- Feb 9, 2024

- ESG News

- Feb 5, 2024

Amazon Fund for Rainforest Achieves Record $640 Million in New Pledges in 2023

The Fund’s revitalization saw new donations from Germany, Norway, the USA, Switzerland, and the UK, totaling R$3.5 billion. Additionally, announced resources from the European Union, Norway, the USA, the UK, and Denmark are in negotiation, reflecting a robust commitment to Brazil’s forest restoration efforts. Campello affirmed, “We will be happy to receive the missing resources, and Brazil needs it, even more so with the new forest restoration front in the Amazon.”

Successful ESG Strategies Can Be A Path For Growth

ESG and sustainability strategies are no longer nice to have—they are becoming central to successful business strategies as external stakeholders put increased pressure on organizations to demonstrate how they are making a positive impact in the communities they serve. These strategies are quickly becoming key differentiators for leaders around the world.

- Mark Hickman

- Jan 31, 2024

- ESG News

- Jan 30, 2024

IESBA Launches Public Consultation on New Ethical Benchmark for Sustainability Reporting and Assurance

Two new exposure drafts set forth the first comprehensive suite of global standards on ethical considerations in sustainability reporting and assurance

Proposed standards aim to foster greater trust in all publicly communicated sustainability information through the application of a consistent ethical approach

The IESBA welcomes comments from the entire sustainability community – professional accountants, all other sustainability practitioners, regulators, and investors

HSBC Unveil Their First Net Zero Transition Plan

HSBC’s Net Zero Transition Plan demonstrates a comprehensive and ambitious approach to navigating the path towards a net zero future. Its focus on real-world impact, sector-specific strategies, and collaborative partnerships positions the bank as a key player in shaping the financial landscape of the low-carbon economy.

- ESG News

- Jan 25, 2024

- Brendan O’Reilly

- Jan 17, 2024

Navigating Telecoms In 2024: ESG Commitments, The Digital Trust Race And More

This year, more than ever before, consumers are defining the direction of ESG. As an example, products with ESG credentials on their labels grew at a rate of 6.4% per year, in comparison to 4.7% yearly growth for products that didn’t, according to research from McKinsey. Making it clear that ESG credentials are crucial for driving sales growth. Consumers want to see businesses not only doing right by the planet but right by them, too.

EU Freezes F-Gases, Paving Way for Cleaner Future

With 457 votes in favour, 92 against and 32 abstentions, MEPs endorsed a deal reached with the Council to further cut emissions from fluorinated gases. The text foresees a total phase-out of hydrofluorocarbons (HFCs) by 2050, including a trajectory to reduce the EU consumption quota between 2024-2049.

- ESG News

- Jan 16, 2024

- ESG News

- Jan 16, 2024

PwC CEO Survey: Climate Concerns Drive Transformation Agenda

As CEOs establish priorities, many are seeing the climate transition as an industry disruptor containing distinct opportunities in addition to risks. Nearly one-third expect climate change to shift the way they create, deliver, and capture value over the next three years – up from less than one-quarter who said as much regarding the past 5 years.

Digital Solutions For A Greener Tomorrow: Harnessing Technology For ESG Strategies

Across the world, companies are taking steps to ensure a more ESG (environmental social governance) approach to their business. One Edelman report found that 92% of U.S. investors stated that “a company with strong ESG performance deserves a premium valuation to its share price.”

- Sebastien Bardoz

- Jan 12, 2024

- Sean Rahilly

- Jan 12, 2024

The Intersection Of Fintech And ESG

While a common assumption is that fintechs have minimal negative environmental impact, it is not entirely absent. There is a need to establish future requirements for companies to manage their operations with a focus on ESG principles.

Nonetheless, stakeholders are increasingly concerned about the performance of companies, which has led to governments, investors, customers and employees requesting more information about how they address these issues.

Germany Hits 70-Year Low in CO₂ Emissions, Agora Energiewende Study Reveals

Germany’s CO₂ emissions fell to their lowest level in 70 years in 2023. A large part of this reduction is due to an unexpectedly sharp decline in coal use. At the same time, emissions fell at the expense of energy-intensive industry as the economic situation and international crises prompted a drop in production. To achieve lasting emissions cuts, the German government must close gaps in its climate policies in 2024 – particularly in the transport and buildings sectors.

- ESG News

- Jan 5, 2024

- ESG News

- Jan 5, 2024

First Solar and Cleantech Solar to Offset 7,000 Kilotons of CO2 with 150 MW Renewable Energy

First Solar, Inc. announced that it has entered into a 15-year, captive Power Purchase Agreement (PPA) with Cleantech Solar, a leading provider of renewable energy solutions to corporations in India and Southeast Asia. Under the agreement, Cleantech Solar will construct 150 megawatts (MW) of photovoltaic (PV) solar and 16.8 MW of wind-generating assets in Tamil Nadu, India, supplying approximately 7.3 gigawatt-hours (GWh) of clean electricity to First Solar’s new 3.3-gigawatt (GW) vertically integrated solar manufacturing facility, also located in Tamil Nadu.

Germany’s Renewable Energy Milestone: Over 50% of 2023’s Electricity Sourced Sustainably

Renewable energies covered almost 52 percent of gross electricity consumption in 2023. This is shown by preliminary calculations by the Center for Solar Energy and Hydrogen Research Baden-Württemberg (ZSW) and the Federal Association of the Energy and Water Industry (BDEW). This means that the share has increased by 5 percentage points compared to the same period last year and is above the 50 percent mark for the first time for a full year.

- ESG News

- Jan 3, 2024

- ESG News

- Dec 27, 2023

Morningstar Debuts Transatlantic SDG Index with Sustainalytics and Citi for ESG Impactful ESG Investing

The new index joins Morningstar Indexes family of sustainable investing index solutions, a global range of market indexes designed to help investors address a variety of sustainable investment goals including ESG risk, climate and impact. Morningstar continues to develop a broad range of market data, insights, investment tools and research to help a wide spectrum of sustainable investment goals across markets.

SHEIN Customer Study Reveals Growing Embrace of Circular Fashion Practices

A recent study conducted by SHEIN, in partnership with Alchemer, delves into the fashion habits and sustainability attitudes of its customer base. Surveying over 3,500 individuals across the US, Mexico, Brazil, the UK, France, and Germany, the research sheds light on five key insights into SHEIN customers’ understanding and engagement with circularity in fashion.

- ESG News

- Dec 27, 2023

- Rob Almond

- Dec 19, 2023

Leading With Purpose: Living Beyond The ESG Report

In recent years, the spotlight on environmental, social and governance (ESG) reporting has intensified. Shareholders, customers and the global community expect more from businesses than just profits. They demand ethical and sustainable practices, robust governance and a commitment to social welfare. While publishing an ESG report is a step forward, leadership goes beyond documentation—it requires living these principles every day.

AI And ESG Linkages Are Critical To Our Society

AI ESG specializations will become a new career path for many – and I for one will be learning beside them. With the emerging AI laws we will need more compliance and auditing on high risk AI models, so expanding the ESG operating mandate should be a priority for all boards of directors and have CEO attention.

- Cindy Gordon

- Nov 30, 2023

- Jorge Gonzalez Henrichsen

- July 11, 2023

ESG Principles: Why Manufacturers Must Embrace Sustainability

Large manufacturers increasingly demand that their suppliers also adhere to these standards, ensuring that goods are produced sustainably and that employees are held in high regard. As a result, small suppliers who do not incorporate ESG into their business model may risk losing their clients to competitors who have already made these changes.

Pfizer Announces Commitment to Accelerate Climate Action and Achieve Net-Zero Standard by 2040

- Pfizer aims to achieve net-zero targets ten years earlier than the expectations of the Net-Zero Standard

- Commitment is aligned with Pfizer’s Environmental, Social and Governance (ESG) priorities

- Pfizer also signs voluntary U.S. Department of Health & Human Services (HHS) pledge committing to reduce Greenhouse Gas (GHG) emissions and accelerate climate action

- June 30, 2022

- Corporate

- July 05, 2022

HKEX LAUNCHES HONG KONG INTERNATIONAL CARBON MARKET COUNCIL, UNVEILS CARBON MARKET PLANS

Hong Kong Exchanges and Clearing Limited (HKEX) is today (Tuesday) pleased to announce the launch of the Hong Kong International Carbon Market Council (the Council). HKEX is partnering with a number of leading corporates and financial institutions as inaugural Council members to explore carbon opportunities in the region.

PwC Australia launches 130-strong new business to help Australia with its $500bn transition to a clean energy economy

PwC Australia has formed a new dedicated Energy Transition business, establishing a hub of 132 experts to help facilitate Australia’s successful transition to a decarbonised economy by 2050.

- PWC

- 2022

- Glenda Korporaal

- July 04, 2022

ASX 200 companies respond to rising pressure for ESG disclosure: ACSI chief executive Louise Davidson

Rising pressure from investors, regulators, and society is pushing many ASX 200 companies to improve disclosure on environmental, social and governance (ESG) risks, according to Louise Davidson, the chief executive of the Australian Council of Superannuation Investors (ACSI).

ESG issues covered at QME event

Mining industry thought leaders will gather from July 19-21 at the Queensland Mining and Engineering Exhibition in Mackay to inspire and share insights at the Seminar Series, sponsored by Komatsu.

On Thursday, July 21 at 10:10am, a panel that’s both timely and topical will focus on mining leadership in environmental, social and governance (ESG) issues, with contributions from ESG leaders across industry, academia, public sector and consulting backgrounds.

- Ray Chan

- June 14, 2022

- Timothy Rahill; Maureen Schuller; Jeroen van den Broek

- July 05, 2022

European Central Bank takes a swing at ESG

On Monday, the ECB lifted a further corner of the veil on how it will integrate climate change into its monetary policy operations. The ECB announced that it will begin to decarbonise its corporate bond holdings. We take a look at the specifics of the collateral framework, and what this means for the ESG credit market